Credit Counselling with EDUdebt: Your Trusted Partner in Singapore

Credit Counselling with EDUdebt: Your Trusted Partner in Singapore

Blog Article

The Relevance of Credit Rating Counselling: A Comprehensive Guide to Improving Your Financial Health

Credit report coaching acts as a crucial source for people looking for to improve their economic health and wellness, supplying customized methods and insights that address particular financial obstacles. By facilitating a much deeper understanding of budgeting, financial obligation administration, and creditor negotiation, credit report counsellors equip clients to browse their financial landscape with greater self-confidence. Nonetheless, the trip toward economic security typically questions about the efficiency of these services and the choice of the best expert. What factors to consider should one prioritize in this important decision-making process?

Understanding Credit History Therapy

Credit rating counselling acts as a vital resource for individuals facing financial obligation administration and economic proficiency. It entails a process where trained professionals offer assistance and education and learning to assist customers recognize their financial circumstances, create budgets, and produce strategies to take care of financial obligation properly. Debt counsellors review an individual's financial wellness by checking out income, expenses, and existing financial debts.

The key objective of debt counselling is to encourage people with the knowledge and skills required to make informed monetary decisions. This often includes educating customers regarding credit history, interest rates, and the ramifications of various sorts of financial debt. In addition, credit counselling can assist in interaction between clients and creditors, possibly bring about a lot more beneficial settlement terms.

It is vital to acknowledge that credit scores counselling is not a one-size-fits-all remedy; the method can differ considerably based upon specific situations and demands. Clients are urged to engage actively in the procedure, as their participation is critical for accomplishing long-lasting economic stability. By fostering an understanding of liable habits and economic principles, credit therapy lays the foundation for a healthier monetary future.

Advantages of Credit Rating Therapy

Among the most substantial advantages of debt therapy is the personalized support it supplies to individuals dealing with financial difficulties. This customized method makes sure that customers obtain guidance specific to their special monetary scenarios, allowing them to make enlightened decisions concerning their costs and financial obligations. Credit report counsellors analyze customers' economic health and wellness, assisting them determine underlying problems and develop actionable plans to boost their circumstances.

Additionally, debt counselling provides education and learning on effective budgeting and cash administration strategies. Customers obtain valuable insights right into their costs behaviors, equipping them to make better economic options progressing. This academic element not only aids in immediate debt resolution but additionally cultivates lasting economic proficiency.

An additional key benefit is the capacity for bargaining with lenders. Credit history counsellors often have actually developed connections with banks, enabling them to advocate on behalf of their clients for lower rate of interest or more convenient settlement terms. This can result in significant financial savings in time.

Ultimately, credit rating therapy can reduce the psychological stress related to economic problems. By outfitting individuals with the devices and sources they require, it cultivates a sense of empowerment, assisting them gain back control over their financial futures.

Exactly How Credit Scores Therapy Functions

Engaging with a credit therapy solution generally starts with a try these out first assessment, where a trained credit score counsellor examines the client's financial scenario. During this assessment, the counsellor collects in-depth info relating to revenue, expenditures, financial debts, and overall financial practices. This detailed understanding makes it possible for the counsellor to recognize the underlying issues adding to economic distress.

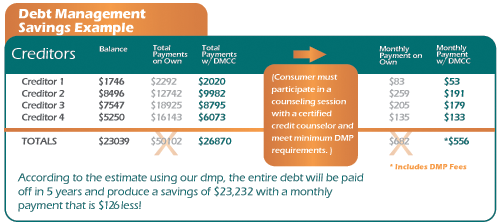

Following the analysis, the counsellor works collaboratively with the client to establish a personalized action plan targeted at improving financial health. This strategy might consist of budgeting methods, financial obligation administration methods, and referrals for credit restoring. The counsellor offers guidance on focusing on debts, discussing with financial institutions, and checking out possible options such as financial obligation management programs or financial education and learning resources.

Clients are urged to actively join the procedure, promoting accountability and dedication to the agreed-upon methods. Routine follow-ups are frequently set up to examine progress and make essential modifications to the strategy. Inevitably, credit rating coaching serves as an essential source, empowering customers to restore control of their funds, improve their credit reliability, and accomplish long-term monetary security.

Selecting the Right Credit Rating Counsellor

Picking a suitable credit counsellor is an important action in resolving financial difficulties effectively. The ideal counsellor can provide useful insights, support, and customized techniques to help you reclaim control of your monetary situation - credit counselling services with EDUdebt. When selecting a credit counsellor, consider their certifications and experience. Seek licensed professionals associated with credible companies, as this suggests a commitment to ethical techniques and ongoing education and learning.

Furthermore, examine their solutions and strategy. Some counsellors offer detailed monetary education and learning, while others concentrate on details problems like financial debt monitoring or budgeting. It's vital to discover a counsellor that straightens with your specific why not try this out needs and convenience degree.

Cost is one more essential element. Numerous non-profit debt coaching agencies offer services at little to no charge, while others might bill fees. Always ask about these charges upfront to prevent unexpected expenditures.

In addition, trust fund your impulses; a great rapport with your counsellor can boost the performance of your sessions. Think about seeking referrals from friends or family who have actually had favorable experiences with credit rating coaching. Eventually, taking the time to pick the ideal credit report counsellor can cause meaningful renovations in your monetary health.

Actions to Improve Your Financial Wellness

Following, create a practical budget that lines up with your financial objectives. Focus on important expenditures while identifying optional spending that can be lowered. Executing a budgeting tool or application can boost tracking and liability.

Financial obligation administration is an additional critical component. credit counselling services with EDUdebt. Think about discussing or settling high-interest debts with creditors for much better terms. Establish a payment strategy that permits regular payments, decreasing general financial debt burden in time

Developing a reserve need to additionally be a concern. Goal to conserve at least three to 6 months' worth of living costs to support against unexpected economic obstacles.

Final Thought

Involving with a competent credit counsellor not only lowers financial anxiety but likewise cultivates responsibility, inevitably contributing to a much more safe and secure monetary future. The relevance of debt therapy can not be overemphasized in the pursuit of monetary wellness.

Engaging with a credit score coaching service usually starts with a first consultation, where a qualified credit report counsellor assesses the customer's financial situation. Ultimately, credit score therapy serves as a vital source, encouraging customers to reclaim control of their funds, boost their credit reliability, and achieve long-term financial security.

Report this page